The Employer National Insurance Contributions Calculator is updated for the 202122 tax year so that you can calculate your employer NICs due to HMRC in addition to standard payroll costs. Heres how unemployment benefits are calculated on a 50000 salary Published Fri May 1 2020 1214 PM EDT Updated Fri May 1 2020 322 PM EDT Robert Exley Jr.

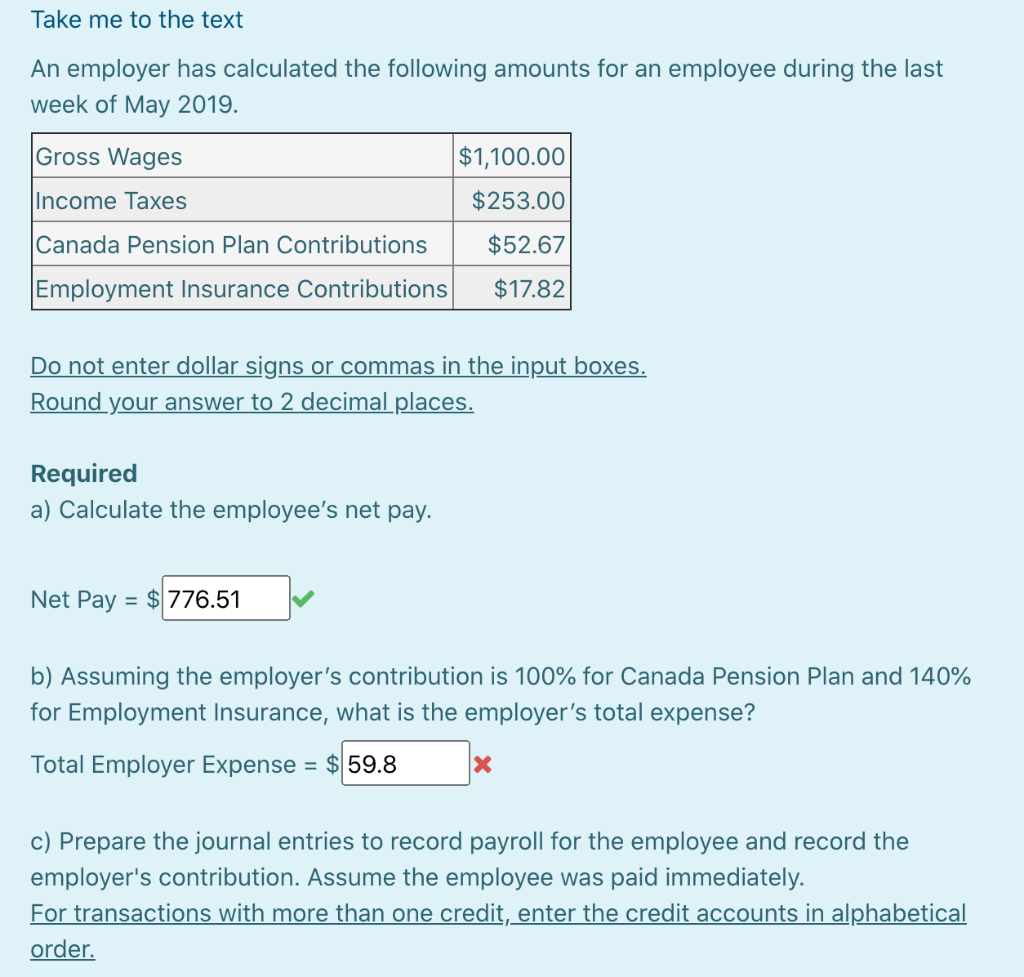

Solved Take Me To The Text An Employer Has Calculated The Chegg Com

Unfortunately theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator.

How is employment insurance calculated. Note that our calculator does not take into account the best weeks. The federal FUTA is the same for all employers 60 percent. This is a simple tool that provides emlploee NI and employers ni calculations withour the Employment Allowance factored in.

Weekly income Gross annual income Number of work weeks or not integrated in our calculator. The employer contribution would be 32515000 which is equal to INR 4875. Employer National Insurance Contributions Calculator 202122 Tax Year.

Unemployment Extension How is unemployment insurance calculated-----Our purpose is the importance of education in our society. Enter the employees EI premium rate for the year See EI premium rates and maximums for current and prior year rates __________. National Insurance is calculated based on a code that is allocated to each employee.

However there are calculators you can use to estimate your benefits. Multiply the amount in step 1 by the rate in. This video was created.

Enter the employees insurable earnings __________. Check your payroll calculations manually. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximum.

Divide your earnings during your high quarter by 26 to calculate your weekly unemployment insurance benefits. The unemployment benefits program starts when an employee gets laid off or let go. The amount you pay will vary depending on your income and employment status.

Heres how you calculate the FUTA tax for this company. It is important to note that employment insurance benefits are taxable. If the gross salary of an employee is 21000 per month then The employees contribution would be 07521000 which is equal to INR 1575.

Therefore the total contribution will be INR11254875 which is equal to INR 600. If you are not entitled to the weekly maximum benefit amount you may be able to increase your entitlement with dependency benefits. How is National Insurance NI calculated for the Employed.

If you are a full-time employee or if you have an employer then Class 1 National Insurance contributions will be applicable to you. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Under the Workmens Compensation Act compensation is offered to the workers and their dependents in case of any eventuality like injury or accident that arises in the tenure of employment resulting in disability or death.

National insurance is a deduction made to employees earnings and is often seen as running along side tax deductions. Calculating rates There are four things that go into calculating how much an employer will pay to cover their workers with Unemployment Insurance. This calculator has been updated for the 2021-22 tax year.

Your employer will deduct Class 1 National Insurance NI from your salary overtime sick pay commission or bonus maternitypaternity and adoption pay. For most people the basic rate for calculating Employment Insurance EI benefits is 55 of their average insurable weekly earnings up to a maximum amount. Employer NICs Calculator 202122.

The estimation of worker compensation settlement is done based on the incident which has led to the compensation. Alternatively to find out how your bill is calculated see our guide to National Insurance rates. 8000 x 0027 216 per employee.

216 x 10 employees 2160. Calculation of Employment Insurance benefits. You can use our calculator below to work out how your NI contributions will be in the current tax year.

The most common NI code A is applied to employees aged 21 to state pension age. Because it is their responsibility to pay your National Insurance NI. It will be updated in due course to show rates in.

This means that you can receive a maximum amount of 595 per week. As of January 1 2021 the maximum yearly insurable earnings amount is 56300. For example if you earned 9000 during your high quarter calculate 900026 to find that your weekly check will be 34615.

Regular employment insurance benefits. To use our Employer National Insurance Calculator simply enter your annual salary enter the fixed annual bonus and enter the percentage annual bonus. To calculate your employees EI premiums using the manual calculation method follow these steps.

1 the taxable wage base 2 the social cost rate 3 the benefit cost ratio and 4 the reserve factor. We determine the average weekly wage based on wage information your employers report. For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income.

Heres how to pay state unemployment taxes for your small business. However the calculation method and the full scope of NI is often mis-understood. If your high quarter earnings were 3575 or less divide by 25 instead.

Unemployment Benefits Wikipedia

New Employment Insurance Rules Take Effect Sunday Saltwire

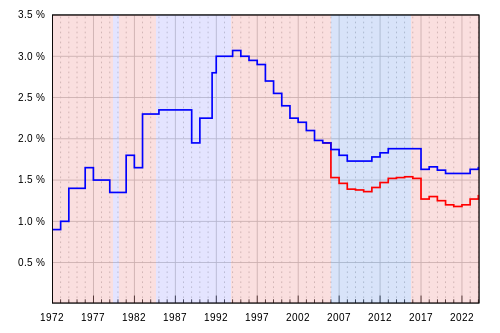

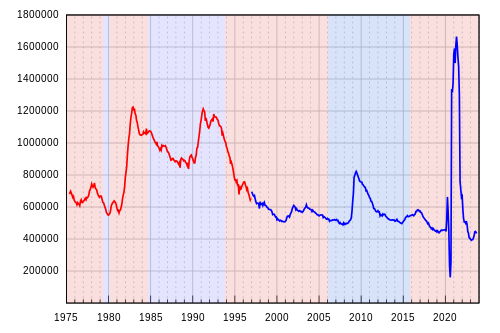

2020 Actuarial Report On The Employment Insurance Premium Rate

Payslip In Germany How Does It Work Blog Parakar

Covid 19 Employment Insurance And The Canada Emergency Response Benefit Badre Law Pc

2021 Actuarial Report On The Employment Insurance Premium Rate

Social Security Taxes Expatrio Com

Understanding The Insurance Benefits Type In Sap Successfactors Employee Central Global Benefits Sap Blogs

Payslip In Germany How Does It Work Blog Parakar

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

How To Calculate Your Unemployment Benefits

Expert Formula Help Calculating Employee Health Insurance Costs

Understanding The Insurance Benefits Type In Sap Successfactors Employee Central Global Benefits Sap Blogs

Understanding The Insurance Benefits Type In Sap Successfactors Employee Central Global Benefits Sap Blogs

Unemployment Benefits Wikipedia

Des Covid 19 Information For Individuals

There Are New Rules For Employment Insurance Here S What You Need To Know Ctv News

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

How To Calculate Your Unemployment Benefits

Payslip In Germany How Does It Work Blog Parakar

Post a Comment

Post a Comment